Choosing an Accounting System: The Best One

One often overlooked aspect of starting a small business is choosing an accounting system. If you are a business owner, you may have a lot of questions about what accounting system to choose.

There is not one system or option that works for all. Although an accountant might tell you what you should choose, that is only their opinion. It is your business and your choice. Consider the information below and then determine what you think will work best for you.

What is an accounting system?

An accounting system is a system that tracks your business transactions, starting with what happened in your business bank accounts. At a minimum, an accounting system provides a profit & loss statement. Some accounting systems provide more financial reporting and information than the profit & loss statement, such as a balance sheet, cash flow statement, and other reports.

Is an accounting system necessary?

Even if the accounting is done one paper or in a spreadsheet, some kind of accounting system is necessary. At a minimum, you need to put the numbers together for taxes. If you use a system throughout the year, you get two main benefits as a business owner:

- Tax season is much easier because your numbers are already together and you won't be scrambling to figure out what they are.

- You benefit from knowing what your business net profit is all throughout the year, so you can make timely and informed decisions all year long.

The key is choosing an easy to use accounting system, one that you understand and that provides you with valuable, satisfying information.

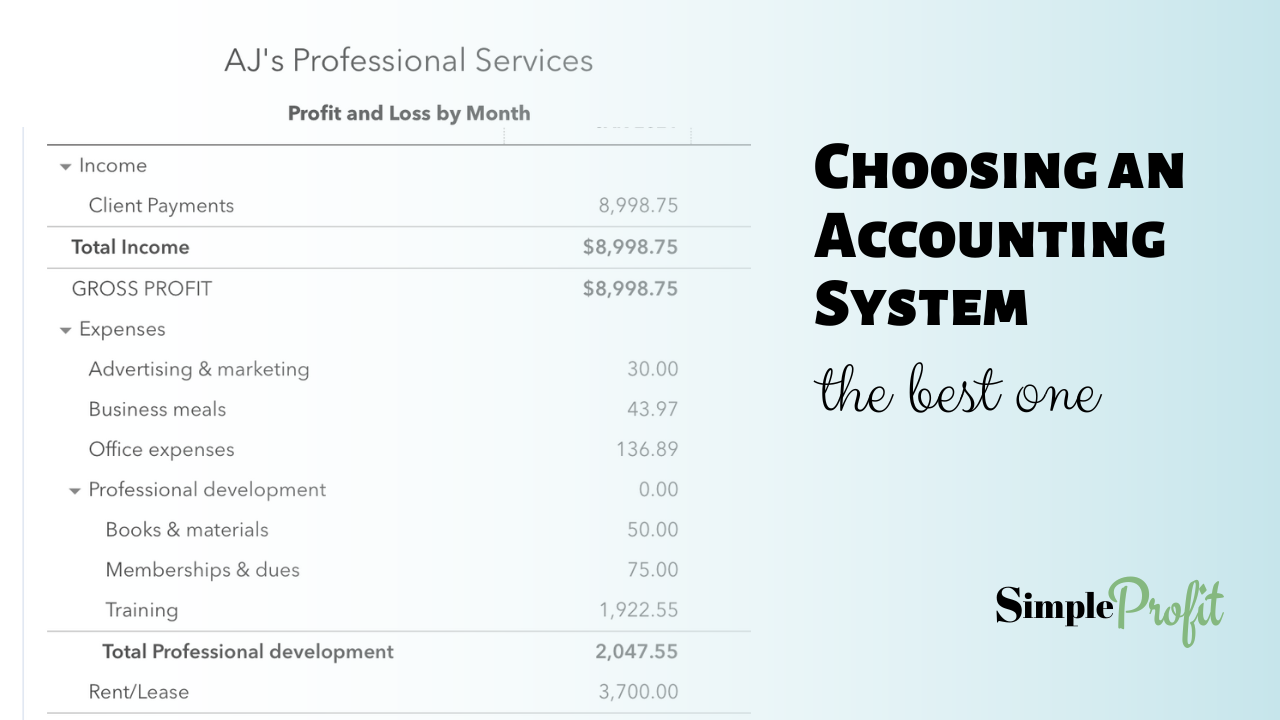

What is a profit & loss statement?

A profit & loss statement is a business accounting statement that shows you the profit or loss of your business for a period of time, such as a month, quarter or year. It shows your business revenues and expenses.

Revenues are payments you received for selling products or providing services. Money you put into the business to start the business is not counted as revenue, only payments you have earned. Revenue can be lumped into one line item or be broken out into categories based on who paid you or what type of service was provided or products sold.

Expenses are costs you have incurred to run the business. Expenses are grouped by category, such as advertising, insurance, office expenses, rent, etc.

See this blog for more information on business expenses:

Business and Personal Expenses: Where to Draw the Line.

A profit & loss statement is one of the most important financial tools to have as a business owner. By tracking revenues and expenses at an appropriate level of detail, you can see at any point what your business has earned and where the money went. This will help you make decisions about paying yourself, spending, hiring, expanding, and saving for business needs as well as saving for taxes.

What is a balance sheet?

A balance sheet is a business accounting statement that shows you the value of your business at a point in time, such as December 31st. It lists the assets that the business holds, including cash in the bank, the liabilities that the business owes, such as a credit card balance, and the equity. Equity is the value of remaining assets if all debts were paid today. Meaning, if you finalized all transactions and closed the business and walked away, the equity is the amount you could walk away with.

A balance sheet is necessary for a partnership, S-Corp or C-Corp as these business types have to report additional information on their tax returns. But a balance sheet is helpful for any business, even a small sole proprietor.

Accounting software

There are many accounting software options with a wide variety of functionally. Accounting software typically falls into two categories, single entry and double entry.

Single entry system

A single entry accounting system is a basic software option that will do the minimum needed to get or keep your information together for taxes. It does not track all the transactions such as cash and debts, but it will track all revenue and expenses. This type of software usually costs less because it does less. A single entry system will provide a profit & loss statement, but not a balance sheet.

QuickBooks Self-employed is a single entry system that will pull your transactions in from a checking, savings or credit card account and create a profit & loss statement, but you cannot create your own categories. The categories line up with the Schedule C tax form, and anything that does not fit into one of these categories ends up in "other business expenses." Also, QuickBooks Self-employed cannot record payroll entries for W2 employees. FreshBooks Lite is another example of single entry software system.

A single entry system can work fine for an independent contractor or small business without employees if they are taxed as a sole proprietor, have no W2 employees and do not care about creating their own expense categories.

Learn more about choosing a form of business here:

Choosing a Form of Business: Options & Factors to Consider.

Double entry system

A double entry system is a full accounting system and will be preferred by any accountant or bookkeeper. This type of system typically will allow the owner or bookkeeper to create customized revenue and expense categories to fit your business operations and provides all possible needed statements for taxes.

Creating customized categories allows you to see the level of detail you want and need to run the business. For example, you can show separate totals for client credit card payments, client cash/check payments and insurance reimbursements. You could also list revenue by type of service, such as direct service vs. speaking revenue. You can create separate expense categories for training and consulting fees or have software listed by type of software, not just lumped into one category together.

Examples of double entry systems are:

QuickBooks Online

QuickBooks Online (affiliate link for an additional discount) is a versatile option that isn't a huge monthly cost. Most small businesses do fine with the lowest tier, called Simple Start. It has a wide range of reporting options. An hour or two of training can really help learn how to use QuickBooks Online well. If you know how to use it, it's generally simple, easy and efficient. Training and help with setup is offered in the Simple Profit membership, for QuickBooks and other options.

Waveapps

Waveapps is a low cost software option. It does not have a many reporting options as QuickBooks Online. But the trade off is there is a much lower monthly cost and it does allow you to customize your categories. Note there is a free version but it does not let you link your bank accounts or customize categories, so it is not recommended. Waveapps is designed specifically for a business owners so it is user friendly. Some training is still helpful, as some aspects of bookkeeping can be tricky.

Note: Recently Waveapps has refused to open a new account for healthcare businesses claiming the reason is that Waveapps is not HIPAA complaint. However, no accounting system is HIPAA complaint and client/patient data needs to stay in the EHR/EMR system. Meaning the accounting system does not need to be HIPAA complaint because it just has totals from the credit card processor, not client or patient data. You can still create a Waveapps account by selecting other as your type of business.

Xero

Xero is popular with many accountants who have moved away from QuickBooks. It can take a little more time to learn how to use and is designed more for accountants and bookkeepers than for business owners to use. Though business owners can use it, it will help to have some training.

FreshBooks Plus

FreshBooks Plus is a software that is user friendly and mainly designed for business owners. It is not often used by accountants or bookkeepers.

Accounting spreadsheet

You can also use a simple spreadsheet to create and maintain a profit & loss statement for your business.

There are two spreadsheets with tutorials you can download in the Simple Profit membership. You can save and use the same template year after year.

Spreadsheets work well for small businesses with no or only a few employees. The larger a business grows the more efficient is to use software, due to the time it takes to track manually. It is easier to make a mistake in a spreadsheet as a typo or failure to copy correctly can lead to incorrect numbers. So it's important to review your numbers each month to ensure all the revenue and expenses have been captured and properly listed.

A benefit of a spreadsheet is you can create your own categories and format to be whatever you want. There are endless options so you can customize to how your brain works and thinks about the numbers.

A spreadsheet is basically a single entry system. Although you can manually create a balance sheet, you will not do the double entries needed to have a balance sheet with equity detail. If you have a partnership, S-Corp or C-Corp, software is better due to the need for a balance sheet statement for the tax return.

How do I choose?

The best system is the one you are going to keep up with. While you may not enjoy the task of bookkeeping, it is satisfying to see the profit number, the result of your hard work, and to know the task is done and your numbers are complete. If you don't like any option, choose the one you dislike the least. Getting some training on the system you choose will lead to more satisfaction with the process and the result.

Join to see a video tutorial in the in the Simple Profit membership on what is like to use QB online, a spreadsheet, Waveapps or QB self-employed. Often, if you see an overview of how each system works, one will emerge as your personal preference.

Your needs may change as your business grows and develops. A spreadsheet might be best for you the first few years, and then moving to software may be needed later on.

What if I hate numbers?

So many of us did not do well in math in school and have an aversion to numbers. If you do not like numbers, the idea of numbers, seeing numbers or hearing numbers, it's important to find a new way to think about accounting.

Although accounting involves numbers, it also represents our business, which we chose to start and now run. The revenue line on a profit & loss represents the work you or your employees did providing services or selling products. It also represents whether you were paid for that work, or paid enough for that work. Expenses represent what it cost to provide the services or sell the products.

The profit is what we earned. It is equivalent to working a job and the gross wages we are promised, before taxes are taken out. If you work for someone else and are paid a $60,000 salary, you know you won't get $60,000 in your account during the year, because taxes come out of that amount. Similarly, if you have a business that brings in $80,000 in revenue and has $20,000 of expenses, you have earned $60,000 before tax. We usually don't shy away from knowing what an employer is paying us, and we need to pay as much attention to what our business earned.

Hopefully you are pleased when you see your profit at the end of a hard month of work, but if not, that can then lead to making changes until you get to the point you are well compensated as a business owner.

Over time, you can learn to hate numbers less and appreciate the story they are telling you about what happened in the past month, quarter or year.

Do I need a bookkeeper?

There are countless business owners doing their own bookkeeping and probably as many using a bookkeeper to keep their accounting system up to date. Here is some information to guide you in your decision making process.

Difference between an accountant and a bookkeeper

An accountant can do bookkeeping and a bookkeeper may be an accountant, but not always. When someone says they are an accountant, that usually means they have a degree in accounting. An accountant could have gone on to get their CPA license or other certifications. Bookkeeping refers to the task of keeping the books and records of a business. Bookkeepers have a wide variety of levels of training in bookkeeping, using software, or accounting. One can learn to do bookkeeping without an accounting background due to the ease of using software.

Business owner role

While a business owner can delegate or outsource the bookkeeping function, the owner remains responsible for the books and records. The information will be used on the owners tax return and when the owner signs the tax return, that means the owner states the information is complete and accurate. So an owner cannot delegate or outsource the responsibility for the numbers themselves.

Therefore it is helpful for a business owner to at least understand the basics of bookkeeping, how the numbers get there, if they are reconciled to bank records. It is also really important to have this information to run the day to day operations.

Factors in doing your own bookkeeping

For many small businesses, it can take a few minutes a week to keep their books. Especially if done regularly, it may not be consuming at all. Keeping your own books as the owner also means you have up to date information any time you want on how your business is performing. This can be an empowering position as a business owner and leads to better and more timely decision making. A bookkeeper may only update your books after the month is over.

A bookkeeper will not always know what an expense was for leading them to have to ask you anyway. When you do your own books, you generally know what you spent or where the deposits came from, so you can quickly categorize the transactions.

if you do your own books, it is important to have support for when you have questions or issues. There will be transactions you aren't sure how to record them, so having a professional to ask questions is necessary. This help can come from the professional who prepares your taxes.

The low cost Simple Profit membership provides education, tutorials, setup services and a place to ask unlimited bookkeeping questions!

Factors in hiring a bookkeeper

There are some excellent bookkeepers who operate as a partnership in helping and supporting your business operations. If you do use a bookkeeper, here are a few factors to consider:

- Know your bookkeepers credentials and experience.

- Know who is actually doing the work. If you hire a CPA firm to do your bookkeeping and taxes, the bookkeeper on staff assigned to your account may have little training or experience.

- Be wary of firms that change your bookkeeper often. The bookkeeper won't have a chance to know you and your business as well with regular staffing changes.

- Consider hiring a solo bookkeeper, to avoid staffing changes. You will still want to know the basics because a bookkeeper can quit, go out of business or disappear and you will need to pick up the task until you find someone else.

- You still can choose your own accounting system, even if someone else does the bookkeeping. It is the home for your business financial records, and it needs to be a system you like and are comfortable with too. Choose a bookkeeper that uses the system you prefer. Always own your own data. This is covered in the next session in more detail.

- The set up of how revenue and expenses are divided into categories is your choice as the owner. The bookkeeper may have suggestions, but the decision is yours. The profit & loss needs to be organized in a way that you can digest and interpret the numbers to help you make business decisions.

- You need to be able to spot when your bookkeeper is making mistakes, so you can take corrective action. So having some training is still useful.

- It can be difficult to determine what is a reasonable cost. Bookkeepers may charge more if you have more transactions and your business is larger, since that will take more time. If you have done your own first, you will know the time involved and this helps you determine the price you are willing to pay for someone else to do it.

- Some bookkeepers go over your numbers with you monthly, or send you a report or summary. Others do not communicate well or often. Choose the level of service you want and make sure you are getting what was promised. Make sure to look at your numbers at least monthly to make sure the work is being done and the numbers are complete and accurate.

- Review the bookkeeping contract thoroughly to know how you will be charged and how problems will be resolved.

Owning your own data when you use a bookkeeper

Bookkeepers exclusively use accounting software. They can be given access to your system, or they can own the system and give you access. Imagine finding mistakes, and wanting to switch bookkeepers only to find out they control all the access to your data and can withhold access if they want. This has happened to business owners. Some bookkeepers feel the books and records are their work product, and may not hand over access if you are ending the contract early. If they own the system, they can lock you out or provide you with nothing more than a data dump of your transactions. Leaving you to start over with a new system.

If you own the accounting system you control the access. You can lock out a bookkeeper who is making mistakes or not doing the work, and hire and add a new one. Your data will not be at risk and can remain intact during the switch.

This may be the single most important factor in using a bookkeeping service. Your financial data is vital to the operation of your business and your ability to correctly report information to the government for taxes. Make sure you do not loose access or control over your data.

External client management systems

Accounting systems are good at doing accounting, but do not necessarily provide robust client tracking and management options. Know the limitations of accounting software and that it usually will not be the only software your business needs.

Accounting systems will do invoicing and track client balances. It can be nice to have this integrated into your accounting system so it's all in one place. But there are times when it's not enough.

Protected Health Information (PHI)

If you work in the medical or mental health fields, you know your client or patient data is protected by HIPAA. PHI is not only a clients name and address, it's also their initials, and account numbers assigned specifically to them. See this page for 18 identifiers that are considered PHI: https://cphs.berkeley.edu/hipaa/hipaa18.html

Accounting systems are not designed to be HIPAA compliant. Even a fully offline system is only protected because it's offline, and still needs to be guarded against unauthorized access and leaks.

Accounting systems start with transactions that occurred in the bank, so it is not necessary to pull in data from your EHR or EMR system into your accounting software. It's best to keep client or patient records completely separate from your accounting system.

If your records in the EHR or EMR do not match your accounting revenue, start by comparing the EHR/EMR information to the bank deposits. Bank deposits are the source for your accounting records, so if your EHR/EMR revenue matches your bank deposits, then it should also match your accounting records. If they are off, one or both is not in agreement with the bank records. The most common differences are 1) timing, since a revenue item may show up in the EHR/EMR a few days before the bank deposit is recorded and 2) EHR/EMR errors, where a record shows up as paid in the EHR/EMR but was never deposited into the bank.

Customer and client management systems

If you are not providing medical and mental health services, you still may want to maintain your customer or client information in a separate system. Customer and client management systems are designed to manage contracts, orders, invoicing, notes and marketing data. This can exceed the capabilities of an accounting software, and it is okay to have two separate systems each serving a different business function.

Your customer or client management system will have some data on revenue collected, which can be compared to bank deposits for accuracy. Bank deposits are the source for the revenue in the accounting system, and accounting records needs to be regularly matched back to the bank transaction data. So if you see discrepancies, it's best to see if revenue in the customer/client management system also agrees to the bank deposits.

Bottom line

Many of us have been in the position of frantically trying to figure out what our business made at tax time, pouring over receipts, feeling lost, frustrated or overwhelmed. If this has happened to you, let that be the last time. Choosing an accounting system you can actually use will help stay organized. It will take less time overall to do it weekly or monthly, when what happened is fresh in your mind, than to try and do an entire year of accounting in one weekend to get ready for taxes.

The best accounting system is the one you like the best. It is a system you can understand, navigate and use. It is best to use a system you control and can maintain access to at all times, even if you use a bookkeeper. The accounting system not only provides information for you to complete your taxes each year, but it tells the story of what happened in your business financially and it can support you in making daily business decisions.

The Simple Profit membership provides support to business owners. Get the education and resources you need to make informed business decisions and establish quality business processes, including bookkeeping and cash management tasks.