Standard vs. Itemized: How Deductions Work

When you file your taxes you are permitted to take either a standard deduction or you may take an itemized deduction if that is larger. This blog will explain the difference between self-employment vs. income tax, business and personal deductions, and standard vs itemized deductions,

Income tax vs. self-employment

For US federal taxes, we pay two kinds of tax. We pay income tax which is a based on taxable income. Taxable income is your total income earned less deductions such as standard or itemized, deducting self-employed health insurance, traditional IRA contribution, student loan deduction, and other deductions.

We also pay social security and medicare tax, which is based on employment or business income. We call this tax "payroll tax" when it's for an employee. The employer pays 7.65% and the employee pays 7.65%. We call this tax "self-employment tax" when it's for a self-employed business owner. The self-employed owner pays the entire 15.3% and deducts half of it, which is deducted from total income as mentioned in the paragraph above.

If your business is a sole proprietor or LLC, you will pay self-employment tax on your self-employed business income, which is the way in which you pay into social security and medicare. If you are a Corp owner, you will have an owners W2 salary and the payroll tax on your salary will be your payment into the social security and medicare tax systems.

Business deductions are separate

Standard and itemized deductions are personal deductions. Every taxpayer can take them on their personal tax return.

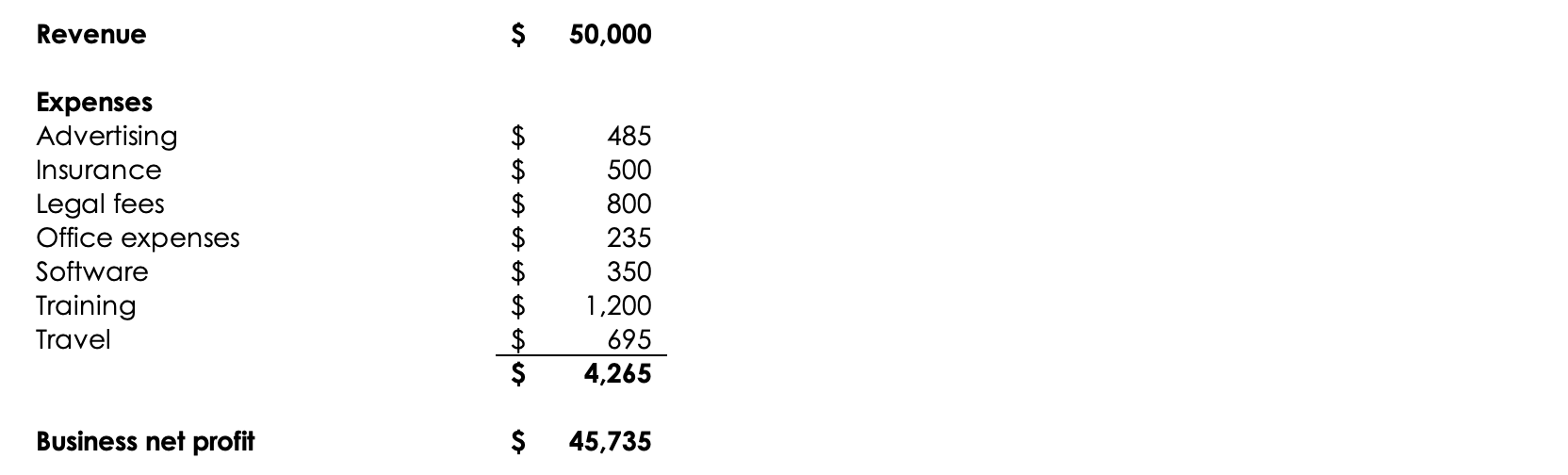

If you own a business, you also get business deductions which are deducted from your business revenue. Business deductions reduce your taxable income in a different way as shown in the example below. Your business has revenue from clients, customers or patients. You also incur expenses to run the business. It might look like this:

You are permitted to take these business deductions in determining your net profit for business. This business profit becomes part of your total income.

Total vs. taxable income

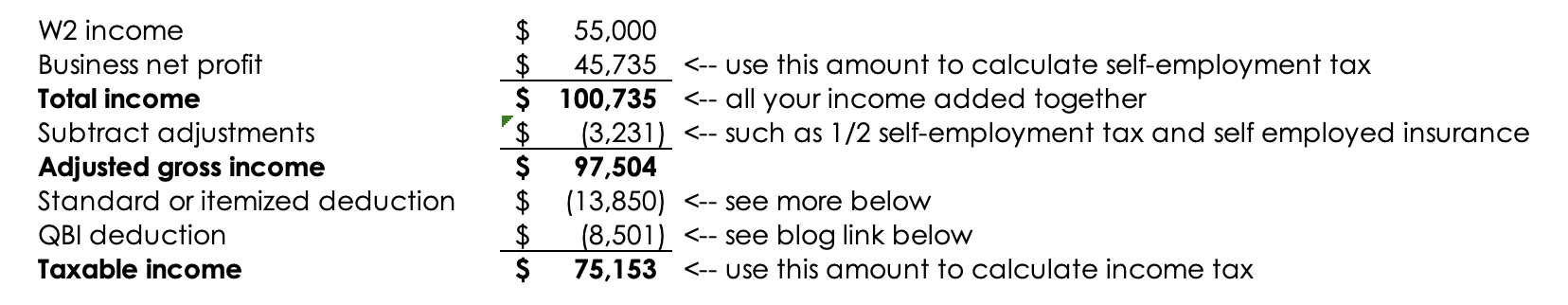

Before we get to the difference between standard and itemized deductions, it's important to know where the standard vs. itemized fits in. The next step of taxes looks like this:

You can see from this example the taxpayer made $100,735 of income, but they are only going to be taxed on $75,153. Taxable income will be used to calculate the income tax. Recall we said above, you'll pay income tax and self-employment tax.

The Qualified Business Income (QBI) deduction is a deduction for pass through business income which is an additional deduction, and often works out to be 12-18% of business income, and reduces the income tax. Click this link to learn more about the https://www.simpleprofit.com/blog/QBI.

Two types of tax calculated

It's going to work out like this:

$75,153 of taxable income 2023 --> $11,841 of income tax

$45,735 of business net profit --> $6,462 of employment tax

So in this example, the total tax is $18,303 unless the taxpayer qualifies for tax credits. Tax credits will reduce the tax even further.

See this link to learn more about tax credits: https://www.simpleprofit.com/blog/taxcredits

Standard deduction

Everyone can take the standard deduction. The main thing to know is you will get the standard deduction no matter what, and you will take the itemized deduction if it is more than the standard deduction. Standard deductions depend on your filing status.

2023 Standard Deductions by filing status:

$13,850 Single

$13,850 Married filing separate

$20,800 Head of household

$27,700 Married filing jointly

2024 Standard Deductions by filing status:

$14,600 Single

$14,600 Married filing separate

$21,900 Head of household

$29,200 Married filing jointly

This is the deduction you can get no matter what.

Itemized deduction

You can itemize if your itemized deductions are MORE than the standard deduction for your filing status. Itemized deduction replaces the standard deduction if itemized is higher.

Itemized deductions typically include:

- Mortgage interest (up to $750,000 of mortgage, or $375,000 if married filing separately; or for a mortgage incurred before 12/16/2017 the limit is $1 million of mortgage, or $500,000 if married filing separately).

- State and local property tax up to $10,000 (state income, local income and property tax).

- Charitable contributions.

- Medical expense you pay out of pocket that exceed 7.5% of your adjusted gross income (Example: if your adjusted gross income, AGI, is $50,000 on your tax return, the first $3,750 cannot be counted in the itemized deductions but expenses over $3,750 can be counted. $50,000 x 7.5% = $3,750).

- Investment interest expense.

- Gambling losses, up to the amount of gambling winnings also claimed separately.

- Qualified causality, disaster and theft losses.

To see if you can itemize, add up all these amounts and see if they total more than your standard deduction based on your filing status. It is usually worth taking the higher amount as a deduction.

About married filing separate

If you are married filing separate there is a rule that if one spouse itemizes the other cannot take the standard deduction. Keep this in mind if you file separate from a spouse.

Self-employed health insurance deduction

If you qualify to take the self-employed health insurance deduction, you can take that deduction whether or not you itemize. Learn more about the rules for this deduction here: https://www.simpleprofit.com/blog/insurance.

If you do not qualify to take the self-employed health insurance deduction, you can count those premiums toward your medical expenses in the itemized calculation.

You cannot count the premiums for your health insurance twice. It's either the self-employed health insurance deduction or add them as itemized deductions, not both.

Bottom line

There are many types of deductions and credits we can qualify on our taxes. Standard vs. itemized is one deduction that reduces taxable income and therefore reduces income tax. You can itemize if the itemized deductions you can take add up to more than your standard deduction, which is different based on your filing status (single, married filing separate, head of household or married filing jointly). If you are not sure what is best or how to calculate it, consult a tax professional. See this blog on interviewing a tax professional: https://www.simpleprofit.com/blog/interview.

The Simple Profit membership provides support to business owners. Get the education and resources you need to make informed business decisions and establish quality business processes, including bookkeeping and cash management tasks.